India’s #1 Cloud-Based

GST Filing Platform for Enterprises

Built for enterprises, tax professionals, and multi-GSTIN businesses across India.

Trusted By your Favorite Brands

How Express GST Automates End-to-End GST Compliance

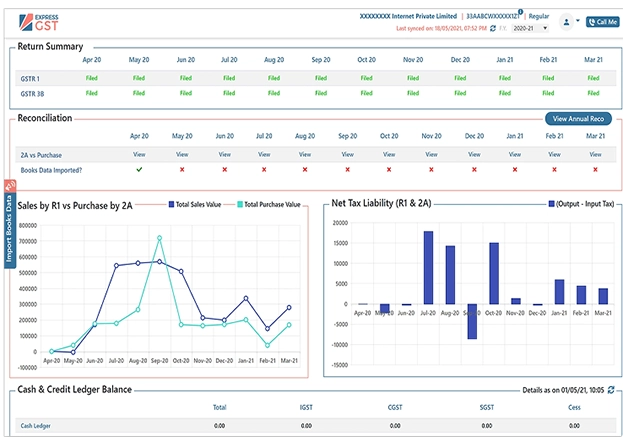

Express GST Reconciles 2A/2B/EWB/e-Invoice/Purchase/Books, Gives you All-In-One seamless workflow.

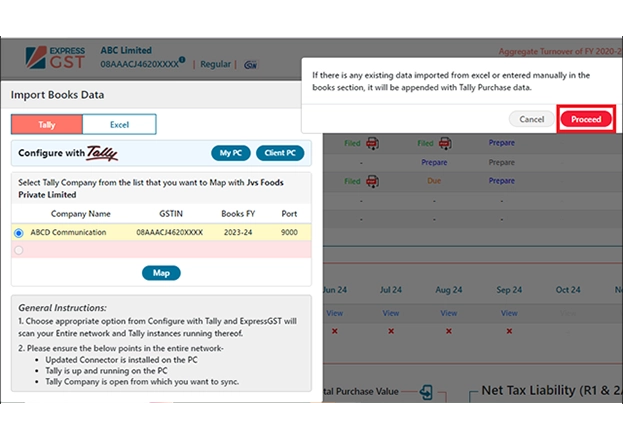

Tally/ERP Integration

Capability to integrate with any ERP or accounting like Tally to Import the Data.

Ready Reconciliation Data

PAN-Level GST Reconciliation, R1 vs 3B vs Books, EWB vs R1, 2B vs E-invoice, Books vs E-Way Bill, Books vs e-invoice, 2A/2B vs Books, 2B vs ITC claimed.

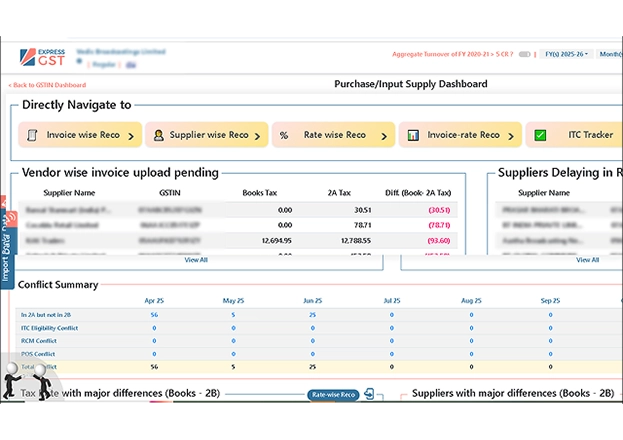

2A/2B Reconciliation

Match every purchase invoice with GSTR-2A/2B in minutes using advanced reconciliation tools. Instantly detect mismatches, follow up with vendors, and ensure no ITC goes unclaimed.

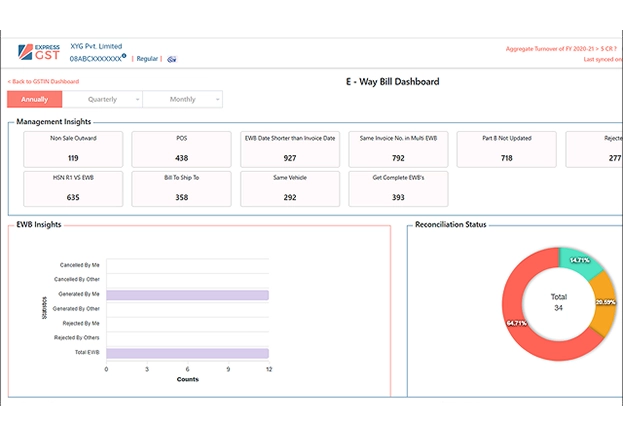

E-Way Bill Matching

Identify discrepancies between GSTR-1 and E-Way Bill data across clients and locations. Spot underreported or overreported invoices early to prevent audits and penalties.

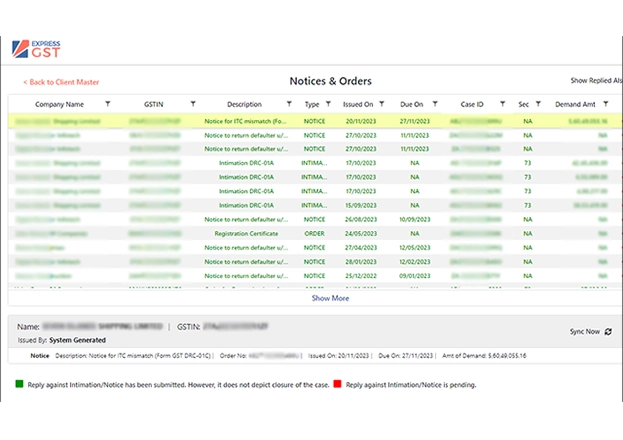

Notice Management

Track all GST notices across all GSTINs from one dashboard. Download all Notices and their Replies in PDF from 2017 to date.

Switch to Express GST in Minutes

Import your data from Tally, Excel, or any ERP with 100% accuracy. All configurations, invoices, and history stay intact so you can start filing instantly.

Simple 3-Step Migration

Data Input

Import lakhs of invoices from Tally, Excel, or ERP-cleaned and ready in one click.

Data Processing

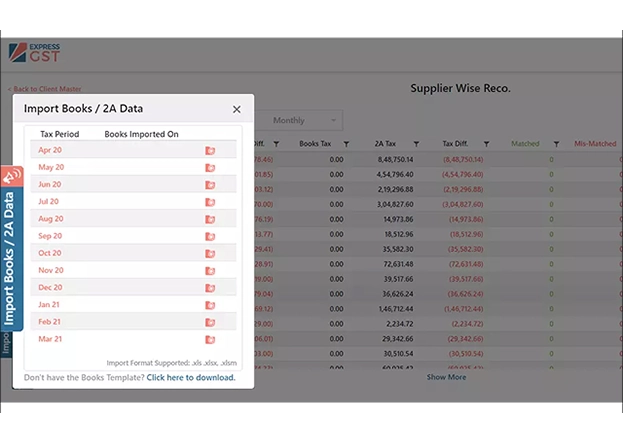

Reconcile GSTR-2A/2B and access all tax summaries from a single screen.

Value-Driven Output

Claim maximum ITC and export audit-ready reports instantly.

Enterprise-grade Security

You trust us, so we’ve built our platform to meet the highest standards of security, privacy and government-grade compliance

SSL Encryption

Your clients trust you with their data—so we’ve built our platform to meet the highest standards of security, privacy, and government-grade compliance.

ISO 27001 Data Storage

All data stored in compliance with ISO 27001 standards, safeguarding your information with top-tier security protocols.

Authorised GSP

Certified by the Government as a trusted GST Suvidha Provider (GSP), guaranteeing reliable and compliant services.

Regular Security Audits

Continuous audits and testing of our systems to identify and address vulnerabilities, maintaining the highest level of protection.

2-Factor Authentication

Add an extra layer of security to your account with 2-Factor Authentication, protecting you from unauthorized access.

User Access Management

Control user permissions and restrict access, ensuring that only authorized personnel can view and manage specific information.

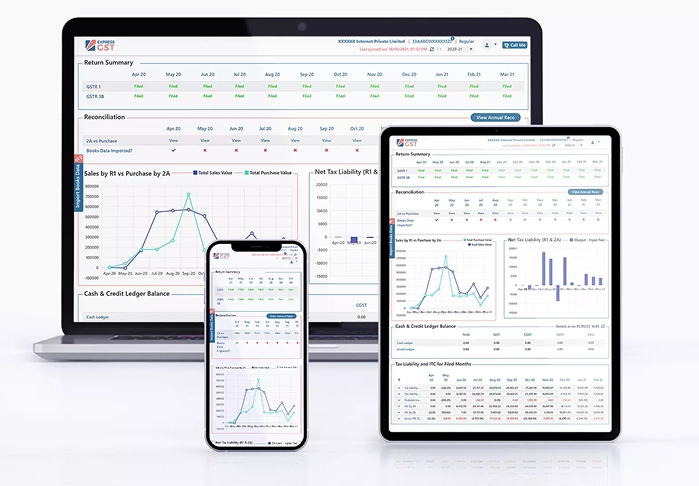

Access Express GST Anytime, Anywhere

Work from your office, home, or even while traveling—without disruption.

Express GST is fully cloud-based and device-independent. Log in from any browser—desktop, tablet, or mobile—and pick up right where you left off. No setup or software installation required. Enjoy real-time access to all your data, filings, and reports with complete security and flexibility.

Try Express GST for Free

File GSTR-1, GSTR 3B & GSTR 9/9C and Reconcile GSTR 2A/2B

data with Books data in Seconds

Simplify your GST return filing experience with Best GST Software

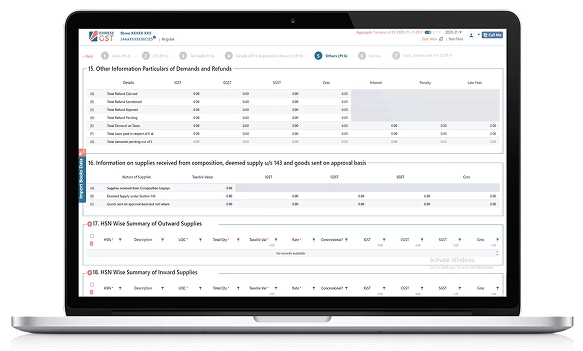

GSTR 9

- Get auto-calculated Data from GSTR 1, 2A and 3B

- Get a Easy and Clear Comparison of Books and Portal Data

- View Reports for each section to figure out any differences between Portal Data and Books Data

- View Multiple Reports of different sections in one go for easy comparison. Drag, Maximise and Minimise reports as per your needs to view Comparisons side by side

GSTR 9C

- View auto-populated details from GSTR 9 Easy and Keyboard Friendly data entry

- Get a Clear Comparison of Books data entered by you and GSTR 9 Data

GSTR 2A/2B

- Invoice Wise Reconciliation

- Supplier Wise Reconciliation

- Excel Like Functionality with Linking or Delinking

- Invoices

- One page View of 2A & 2B

Auto suggestions for invoice linking

RCM and ITC Conflict Invoices view

GSTR 3B

- Multiple Validations and Business Rules for easy and early identification of errors and warnings so that you file only correct data with 100% accuracy.

- Get to know if you have Claimed any Excess ITC or if there is any Probable Liability u/s 75 (12) so that you can take proper actions.

ITC set-off as per amended rules and sections. Keyboard friendly data preparation. - 100% Accurate filing – Single click to auto-fill GSTR-3B with GSTR-1 & GSTR-2B data

- Claim 100% ITC – Check ITC as per GSTR-2B while preparing GSTR 3B

GSTR 1

- View Consolidated GSTR-1 Summary of all the sections on a single page.

- Party-Wise & Section Wise segregation of GSTR-1 Data

- Validation engine (with 100+ checks) for early identification of errors.

- Facility to Import data from Tally & Excel.

What Our Clients Say

FAQs

1. How is Express GST different from other GST software?

Express GST offers end-to-end automation—from data import to filing—with advanced reconciliation, Tally integration, multi-GSTIN support, and notice tracking, all in one platform.

2. Can I migrate from another GST tool without losing data?

Yes. You can import all existing data and configuration settings using Excel or Tally connectors, ensuring 100% data accuracy and continuity.

3. Is Express GST suitable for multi-branch or multi-GSTIN companies?

Express GST offers end-to-end automation—from data import to filing—with advanced reconciliation, Tally integration, multi-GSTIN support, and notice tracking, all in one platform.

4. Does Express GST support e-Invoicing and IRN generation?

Yes. You can generate e-Invoices in bulk, along with IRNs and QR codes, across all GSTINs using a single Excel file—no portal logins required.

5. Can I track ITC across vendors and months?

Express GST offers end-to-end automation—from data import to filing—with advanced reconciliation, Tally integration, multi-GSTIN support, and notice tracking, all in one platform.

6. What kind of support or security does Express GST provide?

Yes. You can generate e-Invoices in bulk, along with IRNs and QR codes, across all GSTINs using a single Excel file—no portal logins required.